Stories

The financially fragile life of a college student.

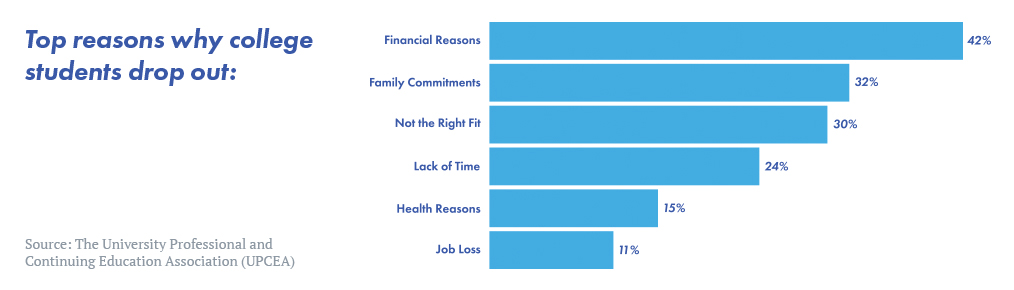

The irony is that students get loans to cover tens of thousands in tuition. And then drop out because they don’t have enough money to buy a laptop.

Here’s another scenario. In order to pay for college, a student gets a part-time job. They need a car to get to work. The car breaks down and they can’t come up with $1,500 to repair or replace it. So, they give up the job. Without the extra income, they end up giving up their college degree, too.

College students are forced to drop out all the time because of an unexpected and therefore unbudgeted expense. Or, even more discouraging, someone in their family loses a job or gets sick and whatever money was being used to help pay for school now must go toward household or medical bills.

A parent or grandparent may be able to come to the student’s rescue and put the laptop on a credit card. But only if they have a high enough limit and there’s enough balance left on the card to cover the price.

CampusDoor’s mission is to work with our lender and institutional clients to make sure students have the money they need to get to graduation day. That means not only ensuring they have loans in place to cover tuition, but that they have fast access to funds for unforeseen expenses.

This is exactly why we developed our microloan platform. Students can quickly apply and be approved for loans ranging from $500 to $10,000. And just like our core platform, the microloan solution can be up and running in about a month.

Have mortgage lenders lost tomorrow’s borrowers to today’s student loan providers?

While the total number of people with mortgages (51 million) is still higher than people with student loan debt (42 million), the value of a student loan customer has risen significantly. And not just because of the loan.

The amount of student loans now has farther-reaching consequences than when it was a much smaller ratio of someone’s debt to income. They take longer to pay off. The monthly payments can impede larger purchases like cars or homes in the future.

But what if you didn’t originate the student loan? Are you locked out of that long-term opportunity?

No. Student loan refinancing is a popular method of consolidating various loans and turning them into one – often lower – monthly payment. As more and more students look to refinance their loans, offering a refi product can help you compete for – and win – those future loans.

Want to know how we can create a student loan refinancing product for you?

Are credit unions key to an educated workforce?

“Knowledge is power. Information is liberating. Education is the premise of progress, in every society, in every family.” – Kofi Annan

States with the highest wages also have the highest number of educated workers, which means investing in education is one of the highest-ROI activities any city, state or nation can choose. While the United States isn’t short on institutions that offer higher education, access continues to be a struggle, especially for families farther down the economic ladder.

Federal student aid helps, but even at the maximum yearly loan amounts, most students are still staring at an education bill they can’t afford.

In the best case scenario, a student can get up to $12,500 in federal student loans per year. That’s just enough to cover the average amount for in-state tuition and fees – but not including housing, food, books, technology, etc.

But that amount is $10,000 less than public, out-of-state tuition and a massive $26,000 less than the average tuition for a private university.

Even for hard-working, responsible students, that’s a significant gap. And for many, it’s an insurmountable expense.

That’s where private loans can mean a world of difference for students – and for Credit Unions.

Credit Unions, already important financial institutions for cities and towns across the country, could be crucial to helping more local students access higher education.

Families looking for private student loans often go to the usual handful of big banks, but if their local Credit Unions offered student loans they’d have good reason to choose that route instead.

Because of their member-owned business model, Credit Unions are well-known for their higher levels of customer service. They also aren’t “too big to fail” which means treating their members right genuinely matters.

Members with established relationships could qualify for a loan in a situation where a big bank, looking only at a spreadsheet, might say no. And Credit Unions often have competitive, or even lower, interest rates.

If education drives prosperity, and private loans create more access to education, then Credit Unions can play an even bigger role in the long-term success of their communities.

Find out how you can help fund the future by exploring our loan origination programs.